Imagine starting your dream business after many years of research and effort. And suddenly you have to deal with the fear of losing it all due to a global pandemic. Yes! That’s the harsh reality of many Micro, Small, and Medium Enterprises (MSME) in India. Hit by the unforeseen circumstances due to Covid-19, followed by a nationwide lockdown, businesses are stuck in turbulent times.

The Union Finance Minister Nirmala Sitharaman has announced a ₹3 lakh crore loan scheme to revive the MSMEs. This collateral-free loan is part of a ₹20-lakh-crore COVID-19 pandemic stimulus package announced by Prime Minister Narendra Modi.

Stimulus Package for MSME: An Overview

- ₹3 lakh crores collateral-free loans for businesses, MSMEs

- Rs 20,000 crores Unsecured Loan for Stressed MSMEs

- 45 lakh units can start businesses again and protect jobs

- Rs 50,000 cr. Equity addition for MSMEs through Fund of Fund

- New Definition of MSMEs

- Way forward for MSMEs

- Rs. 2500 crore EPF Support for both Business as well as Workers for next 3 months

- Clearing receivables of all MSME vendors within 45 days

How can you benefit from Rs. 3 lakh crores loans?

- No collateral: 3 lakh crores worth of collateral-free loans for MSMEs.

- Line of credit: Businesses with an outstanding of up to 25 crores and an approximate turnover of 100 crores would be eligible for the guaranteed emergency credit line facility available under this scheme.

- 12-months moratorium: The loan tenure will be 4 years and a moratorium of 12 months will be applicable to the principal loan amount.

- Last date: The last day for availing this benefit is Oct 31, 2020.

- No fee: Under this scheme, the business doesn’t have to pay an additional fee or fresh collateral.

While announcing the deal, Ms. Sitharaman added that the ₹3 lakh crore package would help 45 lakh units to meet the operational liabilities and resume business and protect jobs.

₹20,000 crores Unsecured Loan for Stressed MSMEs:

MSMEs have been the worst hit during this crisis. Therefore, it is no surprise that a significant chunk of the economic package deal announced by the Finance Minister focuses on reviving MSMEs.

With the help of a ₹20,000 crore unsecured loan, the Government will support 2 lakh MSMEs. Apart from this, the Govt. will also provide ₹4000 crores to CGTMSE (Credit Guarantee Funds Trust for Micro and Small Enterprises).

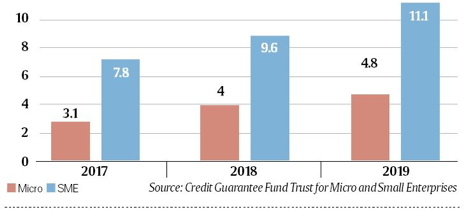

As you can see in the below image, the credit guarantee offered to micro and SMEs has been on the rise, with the year 2019 is the highest till date.

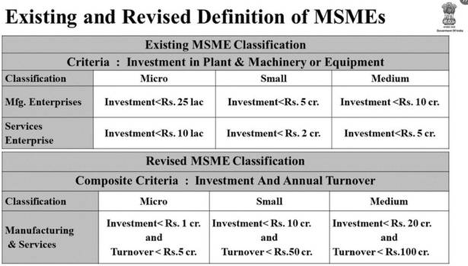

Are you still an MSME? See the new definition

In light of recent events, the very definition of MSMEs has changed, allowing higher investment limits and inclusion of business turnover criteria. There has always been a low limit for MSMEs, that has often limited their desire to grow. This change will benefit contractors and retailers, as the Government plans to distinguish between manufacturing and services. However, the key recipients of this change will be Indian traders.

Take a look at the new definition below

₹50,000 cr. Equity infusion for MSMEs:

Since the lockdown began, the MSMEs have been facing a severe equity crisis. In order to deal with this crisis, the government will set up a Fund of Funds (FOF) with a corpus amount of ₹10,000 cr. A Mother Fund and a few daughter funds will be set up for operating the FOF. This measure will help MSMEs grow their business and production capacity. It will also act as a morale booster and motivate MSMEs to join the main board of stock exchanges.

Goodbye to trade fairs, yes to eMarketplace

Due to the Coronavirus lockdown, the Government will also support e-market linkage, which will act as a substitute to trade fairs and exhibitions.

This is, in fact, the right time for MSMEs to get full benefits of platforms like TradeLeaves to connect with buyers, suppliers and service providers across India. It is a single platform for small and medium businesses to list their products and deal with any trader without leaving the portal.

How to get MSME loans?

The stimulus package will help MSMEs survive the difficult times and restart with enthusiasm. Take a quick look at the documents you need to avail MSME loans.

- Duly filled application form (//www.udyamimitra.in/MSMELoan)

- Residence Proof: Electricity or telephone bill, ration card, trade license, passport, sales tax certificate, and lease agreement.

- Identify Proof: PAN Card, Voter’s identity card, Passport

- Age Proof: PAN Card, Identity Card, Passport

Financial Documents:

- Last 12 month’s bank statement

- Partnership deed copy

- Company PAN copy

- Last 2 years P&L and balance sheet copy

- Municipal tax document

- Business registration proof

- Sales tax documents

EPF Support: Empowering workers, the backbone of MSMEs

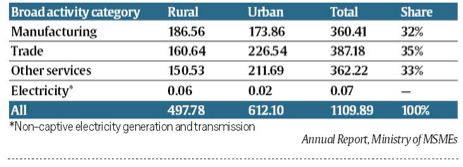

Under the Pradhan Mantri Garib Kalyan Yojana, low-income organized workers in MSMEs will get the employee provident fund support. This 3-month relief will provide approximately ₹2,500 crore worth liquidity to workers. In the following image, you can view estimated employment numbers in the MSME sector.

For the next financial year, both TDS and TCS have been reduced up to 25%. In addition to this, for the next three months, employers and employees will have only 10% provident fund (PF) deductions. There’s also some relief for salaried employees and taxpayers. The due date for income tax returns for the financial year 2019-20 has been moved to November 30, 2020.

These measures will not just safeguard MSMEs, but also revive the Indian economy at large. This is also the time for MSMEs to be innovative in exploring platforms that can help your business reach out to new buyers and sellers in India. You can explore user-friendly digital platforms like TradeLeaves, which can increase visibility and promote your businesses with business-to-business (B2B) networking, advertising, compliance, payment, escrow, procurement, and order-fulfillment.